The London Metal Exchange (LME) is seeking the public's comments on the possibility of banning aluminum, nickel, and copper sourced from Russia from being traded or stored within the LME system.

What’s the role of the LME?

The LME is a futures and forwards exchange with the world's largest market in standardized forward contracts, futures contracts, and options on base metals.

What would a Russian ban mean?

If enacted, the ban would mean that Russian metal could no longer be traded or stored within the LME system.

Which metals are most impacted?

Russia is a major producer and exporter of many primary metals, per the graphic to the right.

How much Russian metal is imported into the U.S.?

The U.S. only consumes roughly 3% of Russian aluminum and 4% of Russian nickel.

.ashx?h=461&w=550&hash=BBCC7F0D8BD644CA7D1DBECC42AE63B3)

“Rumblings of a US ban on Russian aluminum imports has been a hot topic as of late, which in turn has created a short-term spike in LME prices. Overall though, based on the limited levels of Russian aluminum coming into the U.S., it is not anticipated that this will cause any supply chain disruptions in the U.S.” – Jeff Nodes, Ryerson's Director of Supply Chain, North Region

What Could It Mean for Nickel?

“At this time we do not see an near-term effect on the supply of nickel to our customers or our mill partners. This is due to the fact that, if a ban is implemented or Russian metals are prohibited, this action would impact future material coming from Russian. But with all that being said, it remains a volatile market and we will be monitoring this situation closely," Jim Reed, Ryerson's Director of Supply Chain, West Region

Beyond the news of a potential ban on Russian material, nickel has endured an interesting run as of late. At the beginning of September, the price of nickel saw a rally, increasing 25% to around $11.50/lb. That price has seen fallen back to around $10/lb.

Source: Bloomberg

The price of chrome recently reset at $1.49/lb, down from $1.80/lb. This downward movement aligns with supply chains in South Africa, where most of the chrome is produced, loosening up a bit.

This reset could help push stainless surcharges lower. Projections call for November surcharges to be down 6.4 cents for 304 and down 5.3 cents for 316 compared to October.

Will Capacity Stymie Steel Supply?

In other metal market news, steel sheet prices continue to soften, as a combination of flat demand, ample supply, and declining mill input costs have led to the lowest levels we have seen since Q4 of 2020.

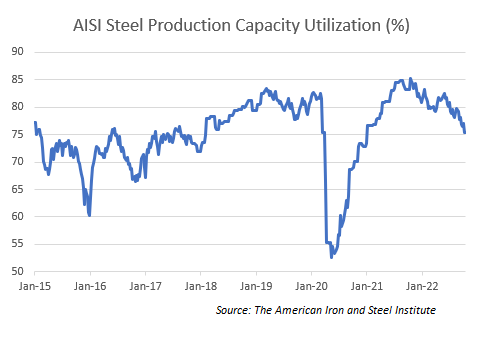

But could mill output cause any hiccup with regards to supply? Mill utilization rates remain less than 80%.

According to The American Iron and Steel Institute, for the week ending on Oct. 8, 2022, domestic raw steel production was 1.68 million net tons with a capacity utilization rate of 75.3%. This was down from 1.836 million net tons produced at a capacity rate of 83.2% in the same week last year.

Now we are in Q4, during which many steel mills have scheduled year-end maintenance outages. News came in late September from US Steel that it will keep its blast furnace in Mon Valley, Pennsylvania, down.

This comes on the heels of the steelmaker announcing in early September that its blast furnace in Gary, Indiana will also remain idle. Combined, the furnaces produce an estimated 7,945 short tons of raw steel per day.

On the steel plate front, the pricing spread between hot rolled carbon and plate remains historically high at roughly $850/ton. This despite price decreases from a few domestic mills as of late.